Swammerdami

Squadron Leader

Male bovine excrement. Gala apples used to be about $.49 per pound, they have been over $1.99 per pound for over a year now. Meat prices are horrendously expensive. Everything is way more expensive. Gas is well over $5 a gallon in SoCal.

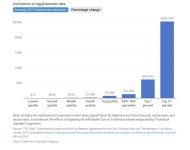

I doubt that EVERYTHING is way more expensive. There are PERCEPTIONS about pricing. For example, someone hoping that prices rise when a politician they dislike is in charge is likely to focus on prices which are up. Just to illustrate that prices fluctuate independently, I graphed nine, mostly global prices from the 2011 to the present. The selections were poorly chosen (and Fred lacks many prices one might want to plot). If I were to do again I'd plot various categories of U.S. producer prices. These are not the consumer prices Mr. Swiz wants to look at; but I don't know any site which has good data for that, let alone graphing tools as good as Fred's.

The 28-month Covid price shock is clearly visible. Since then, global prices for cotton, corn, steel pipes and wheat(!) have fallen back, almost to Trump-era prices if my eyes make out the colors correctly. Is it not the case that it is with products where an oligarchy (or "rent-collectors") has control (or where a labor union has exerted recent power!) that U.S. prices have not fallen back to pre-Covid levels?

Petroleum pricing is heavily influenced by Saudi Arabia and Russia. (Although not allied with Iran, Saudi and Russia are both big dogs in the Axis of Evil given (a) willingness to use mischief and violence, (b) economic power (in this case, supply and price of petroleum), (c) hope that Trump will win the November election.

Questions for discussion:

(1) Will Russia and Saudi deliberately squeeze petroleum production and/or raise prices during this year's early autumn? Both do hope Trump wins, and high gasoline prices will devastate Biden's chances. (How's our Strategic Reserve?)

(2) Why the high price of apples? What about other basic U.S. groceries? Can someone, preferably with citation, prepare data on prices of other basic foodstuffs?